TAX PLANNING FOR COUPLES

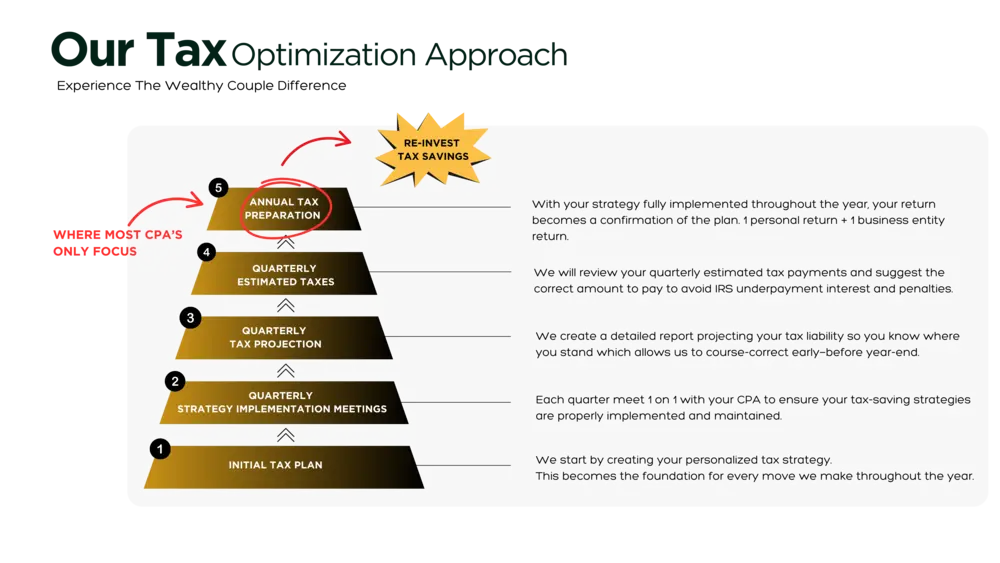

At The Wealthy Couple, we specialize in tax planning strategies designed exclusively for business owners. Our goal is to help you minimize your tax liability, maximize profitability, and keep more of your earnings for business growth. With our proactive approach, we ensure you take advantage of every tax-saving opportunity available.

Why Tax Planning Is Essential for Couples?

Many couples end up overpaying taxes simply because they don’t have a coordinated plan. The right tax strategy can help you:

Legally reduce your household’s taxable income

Maximize deductions and credits available to couples

Improve cash flow for shared goals like travel, homeownership, or retirement

Stay compliant and avoid costly tax penalties

Prepare for future tax obligations with confidence

How We Help Couples Build Wealth Together

Your financial strategy as a couple should be as aligned as your life goals. That’s why we take a holistic approach—helping you make smart, tax-efficient decisions that support your short-term needs and long-term dreams as a team.

Strategic Tax Planning for Couples

Effective tax planning can significantly impact your financial future as a couple. We help you navigate the complexities of tax regulations, optimize your filing status, and identify opportunities for deductions and credits that reduce your tax burden and increase your savings.

Tax-Efficient Cash Flow Planning

Our approach goes beyond simple budgeting. We design strategies to maximize after-tax income, ensuring that more of your money stays with you. This includes optimizing income streams, managing taxable events, and planning for major life changes that affect your tax situation.

Long-Term Tax Savings for Your Future

We believe smart tax planning is essential for building lasting wealth. We work with you to structure retirement accounts, investment strategies, and estate plans that minimize future tax liabilities, setting you up for financial security and generational wealth.

How We Help Couples Build Wealth Together

Your financial strategy as a couple should be as aligned as your life goals. That’s why we take a holistic approach—helping you make smart, tax-efficient decisions that support your short-term needs and long-term dreams as a team.

Strategic Tax Planning for Couples

Effective tax planning can significantly impact your financial future as a couple. We help you navigate the complexities of tax regulations, optimize your filing status, and identify opportunities for deductions and credits that reduce your tax burden and increase your savings.

Tax-Efficient Cash Flow Planning

Our approach goes beyond simple budgeting. We design strategies to maximize after-tax income, ensuring that more of your money stays with you. This includes optimizing income streams, managing taxable events, and planning for major life changes that affect your tax situation.

Long-Term Tax Savings for Your Future

We believe smart tax planning is essential for building lasting wealth. We work with you to structure retirement accounts, investment strategies, and estate plans that minimize future tax liabilities, setting you up for financial security and generational wealth.